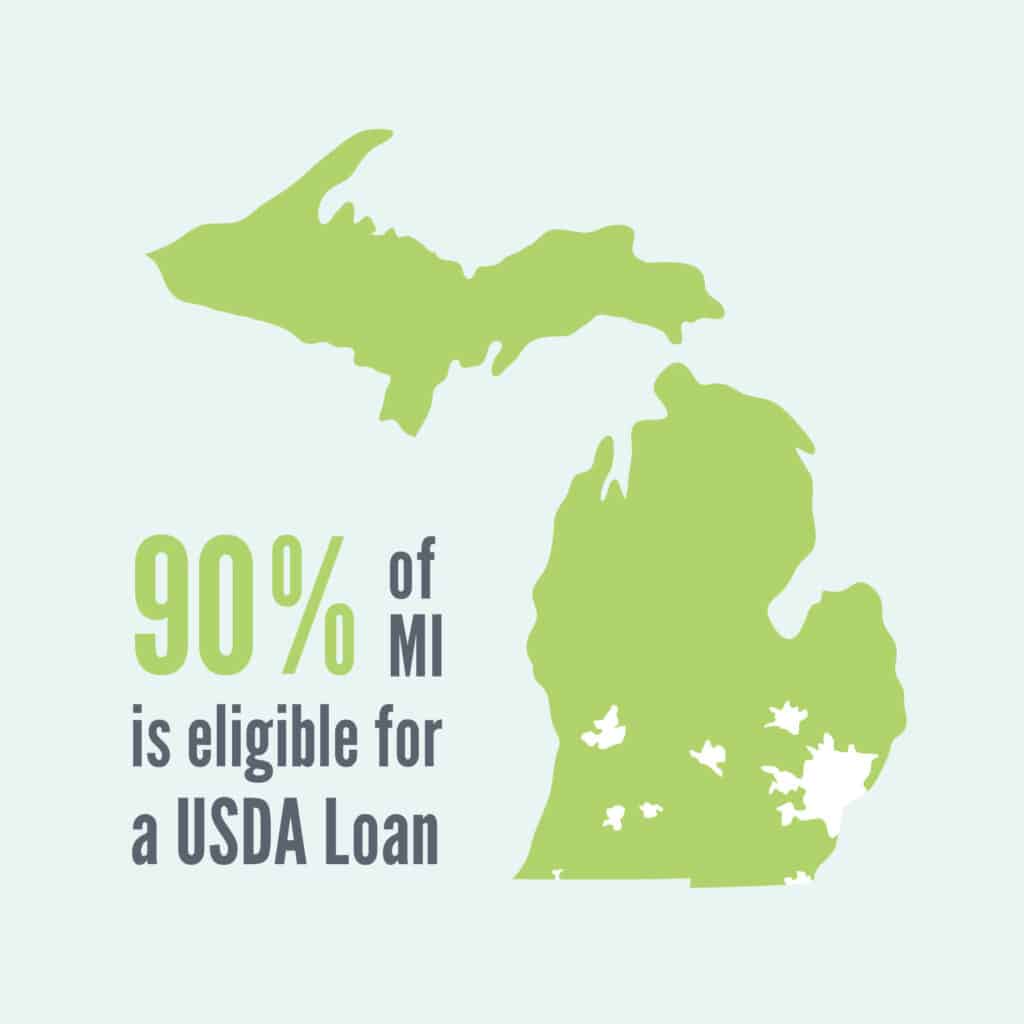

USDA Eligibility Map

How to Qualify for a USDA Loan in Michigan?

If you’re being pulled toward the attractive features of a USDA Loan, whether it’s the competitive interest rates or zero down payment opportunities catching your eye, it’s important to pinpoint your rural development eligibility before moving forward in the loan approval process.

Eligible borrowers and their selected property should meet the following requirements:

- The property in question must be in an eligible location

- The property must also be a single-family, owner-occupied home

- Borrower’s income must be below USDA-set limits (based on your area)

- Minimum FICO score of 620

- Property cannot be a working farm

- The property’s appraisal must meet USDA standards

See the USDA Eligibility Map

Before exploring any of the other eligibility parameters, you’ll want to check the USDA eligibility map to make sure the property you’re thinking of purchasing is in an approved location for RD eligibility.

This map delineates areas deemed rural or semi-rural, determining eligibility for USDA Loans. It highlights regions where borrowers can access affordable mortgage options with low or no down payment requirements. By referencing this map, potential homebuyers can identify eligible locations and explore their homeownership opportunities. This tool ensures that individuals and families in rural communities have access to financing, promoting economic development and stability in these areas across Michigan.

The Top 4 Benefits of USDA Loans

RD Loans offer a plethora of attractive benefits, but the most prominent include:

- 0% down payment

- Closing costs can be included in the loan

- More lenient borrower qualifications than other programs

- Minimum credit score of 620

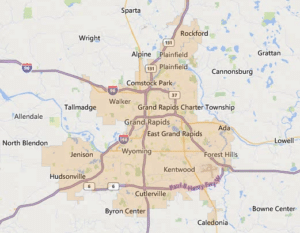

What Areas Near Grand Rapids Qualify for Rural Development Loans?

As you might have figured, Grand Rapids isn’t exactly considered rural, especially not in the eyes of the USDA. The city has a profound population and exceeds the limits for RD eligibility. Still, despite the heart of Grand Rapids and its immediate suburbs lacking that RD eligibility, there are plenty of nearby towns that do qualify for USDA Loans, including:

- Allendale

- Lowell

- Caledonia

- Marne

- Rockford

- Sparta

- Alaska

Additionally, There Are Cities in Northern Michigan That Are Eligible, Such As:

- Traverse City

- Frankfort

- Big Rapids

- Marquette

- Manistee

- Mackinaw City

- Gaylord

- Cadillac

- Escanaba

- Ludington

- Clare

- Houghton

Elsewhere in Michigan, cities like Holland, Grand Haven, Muskegon, Lansing, East Lansing, and Mount Pleasant are all ineligible, but there are surrounding areas near each that may be eligible.

The USDA Income Restrictions for Michigan in 2024

RD eligibility encompasses income limits for applicants, which vary depending on the size of the family. For 2024 in Michigan, the limits are:

- Family size of 1-4 people: $110,650

- Family size of 5+ people: up to $146,050

How Accurate is the USDA Eligibility Map?

The USDA eligibility map is run and maintained by the US government, ensuring its accuracy.

What Does USDA Consider a Rural Area?

The USDA defines a rural area as any location that “consists of open countryside with population densities less than 500 people per square mile and places with fewer than 2,500 people.” This classification encompasses small towns, villages, and countryside regions, aiming to support economic development and provide access to affordable housing in less densely populated areas. USDA Loans allow individuals and families in these rural communities to secure financing for homeownership, underscoring the USDA’s commitment to fostering growth and stability in less densely populated areas.

Are Small Towns Considered Rural?

Small towns are typically considered rural by the USDA for the purposes of eligibility for USDA Loans. However, what constitutes a small town is, at the end of the day, a little bit subjective. Because of this, the USDA caps the defining line for eligibility at towns with 50,000 or more residents. This classification includes small towns, villages, and countryside regions. By extending loan programs to these rural communities, the USDA aims to support economic development and provide access to affordable housing options in areas with lower population densities, helping to bolster growth and stability in smaller towns across the United States.

See If You Qualify for a USDA Loan in Michigan

Ready to explore your homeownership options in Michigan? Start by finding out if you qualify for a USDA Loan – our lenders at Treadstone can help determine your eligibility! With our expertise in navigating USDA Loan requirements and extensive knowledge of Michigan’s housing market, we’ll guide you through the process seamlessly. Whether you’re in a small town or rural area, we’re here to help you secure financing for your dream home. Don’t miss out on this opportunity for affordable homeownership – contact Treadstone today to see if you qualify for a USDA Loan in Michigan and take the first steps toward affordable homeownership.

Terms and qualifications are subject to underwriting approval and can change without notice. Not all borrowers may qualify. Credit score and down payment examples are for illustrative purposes.

Check out your USDA Eligibility Before Applying for a Loan!