RD Loan Myths Debunked : Areas, Limits, Qualifications & More

RD Loan Myths: What You Think You Know Might Be Wrong

RD Loans are only for houses out in the middle of nowhere. You have to be low-income to qualify. They’re harder to get than other loans. Sound the buzzer — these are wrong. RD Loans, also called USDA or Rural Development Loans, have long been misunderstood, and those myths are costing buyers big time. The truth is that this financing option is way more flexible, accessible, and appealing than most people realize. If you’ve written off RD Loans based on what you think you know, it might be time to give them another look.

Myth #1 – RD Loans Are Only for Farms and Rural Areas

Many buyers assume RD Loans are just for houses with barns and tractors in the yard, surrounded by miles of cornfields. But in reality, “rural” means something very different in the eyes of the USDA. Their definition includes many suburban and even semi-urban neighborhoods. We’re talking places with grocery stores, schools, and yes, high-speed internet. If an area has a population under 35,000 and isn’t part of a major metro core, there’s a good chance it qualifies. Actually, over 90% of the state of Michigan qualifies for USDA Loans.

RD Loans were designed to support development in communities that are often overlooked and not just the ones off dirt roads. That means if you’ve been house-hunting in a smaller town or the outer edge of a city, you might be shopping in eligible territory without even realizing it.

How to Check if a Home Qualifies

The USDA makes it easy to see if a property fits the bill. Just head to the USDA Property Eligibility Map, plug in an address, and it’ll tell you right away whether it qualifies. You can search specific homes, scan broader areas, or even compare neighborhoods. If it’s marked “Eligible,” you’re good to go.

Surprising Locations That Qualify for an RD Loan

You might be shocked at how many “normal” suburbs make the cut. In Michigan, areas just outside of Grand Rapids, like Cedar Springs, Sparta, and portions of Caledonia and Hudsonville, all qualify. Don’t let the word “rural” fool you! If you’re house-hunting beyond the urban core, there’s a real chance you could qualify for an RD Loan — and save thousands while you’re at it. Check with one of our Loan Officers to see if you qualify!

Myth #2 – RD Loans Are Only for Low-Income Borrowers

Think RD Loans are just for people with super modest incomes? Think again. One of the most persistent myths out there is that these loans are only available to low-income households. In actuality, the income limits are a lot more generous than most people realize. In fact, many middle-class buyers easily qualify, especially in higher-cost areas or larger households.

RD Loans are meant to serve moderate-income families, not just those living paycheck to paycheck. So before you count yourself out, it’s worth taking a closer look at the numbers.

How Income Limits Actually Work

RD Loan income limits aren’t one-size-fits-all. They adjust based on two key factors: your location and your household size. The USDA sets an income threshold for each area, which usually falls around 115% of the median income for that county or region.

That means if you live in a higher-cost area, that limit goes up. And if you have more people in your household — whether it’s kids, a spouse, or even an elderly parent — your allowed income increases, too. The USDA takes total household income into account, not just the people on the loan, but they also apply deductions for childcare and certain expenses, which can help you stay under the maximum.

Many Middle-Class Buyers Qualify for RD Loans

Here’s where things get interesting: in many areas, a family of four can earn six figures and still qualify. So yes, teachers, nurses, office managers, skilled tradespeople — even couples with dual incomes — often fall comfortably within the qualifying range. The idea that you have to be “low-income” to use an RD Loan is a total myth.

Myth #3 – RD Loans Require a Huge Down Payment

Who is saying this and what else can you not trust them about? Let’s bust this one wide open: RD Loans require no down payment. That’s right — zero percent down. One of the biggest benefits of an RD Loan is its 100% financing option, which makes it one of the few loan programs where qualified buyers can skip the traditional savings hurdle and still get into a home.

So where did this myth come from? Probably from people confusing RD Loans with Conventional Loans, which typically require at least 3%–5% down. But with an RD Loan, if the home qualifies and your income is within the limits, you can finance the full purchase price.

Myth #4 – RD Loans Are Hard to Get Approved For

Some buyers shy away from RD Loans because they assume the requirements are stricter or the process is more complicated — but that’s not the case. In fact, RD Loans are designed to help more people become homeowners, not put up extra hurdles. While there are a few boxes to check, most buyers are surprised at how reasonable the qualifications really are. The difference is working with a team that has the knowledge and the experience to help.

Credit Score Flexibility

Unlike Conventional Loans that often require higher credit scores for competitive terms, RD Loans are usually more forgiving. While a score of 640 or higher is ideal for streamlined approval through the USDA’s automated system, many lenders will still consider applicants with lower scores through manual underwriting.

If you’ve had a few bumps in your credit history but have been making steady progress, you might still be eligible. RD Loans tend to focus more on recent financial behavior than past missteps, making them a strong option for buyers rebuilding credit.

DTI & Other Approval Factors

Your debt-to-income ratio (DTI) plays a role, but RD Loans often allow more flexibility than conventional programs. In general, lenders prefer to see lower DTI’s, but with strong compensating factors, like solid credit or extra savings, that number can be higher.

The USDA also looks at things like consistent employment, stable income, and your ability to repay the loan over time. So no, RD Loans aren’t reserved for only the most “squeaky clean” borrowers. They’re made for everyday buyers who meet a few straightforward guidelines and want to take advantage of a smart, affordable path to homeownership.

Myth #5 – You Have to Give Up Convenience to Use an RD Loan

There’s this lingering belief that using an RD Loan means living in the middle of nowhere — far from jobs, stores, schools, or anything remotely convenient. But in reality, many RD-eligible areas are just a short drive from thriving downtowns, major employers, and everyday amenities.

Suburban neighborhoods, commuter towns, and even some rapidly growing outer-ring communities often fall within USDA boundaries. These places aren’t remote — they’re just outside the hustle of the city center, offering more space, newer homes, and quieter streets without sacrificing access to what you need. In fact, for buyers who want both peace and privacy plus proximity to restaurants, schools, and shopping, RD-eligible areas can be the sweet spot.

Myth #6 – It’s More Expensive to Live Outside the City

A common misconception is that living outside the city means higher costs, whether it’s longer commutes, higher property prices, or more expensive utilities. But in many cases, the opposite is true, especially in RD-eligible areas.

Homes in suburban or rural areas often come at a lower price point than those in urban centers. Plus, the cost of living tends to be more affordable, including everything from property taxes to groceries and gas. And with an RD Loan offering 100% financing, you could be getting more house for your money without the big city price tag.

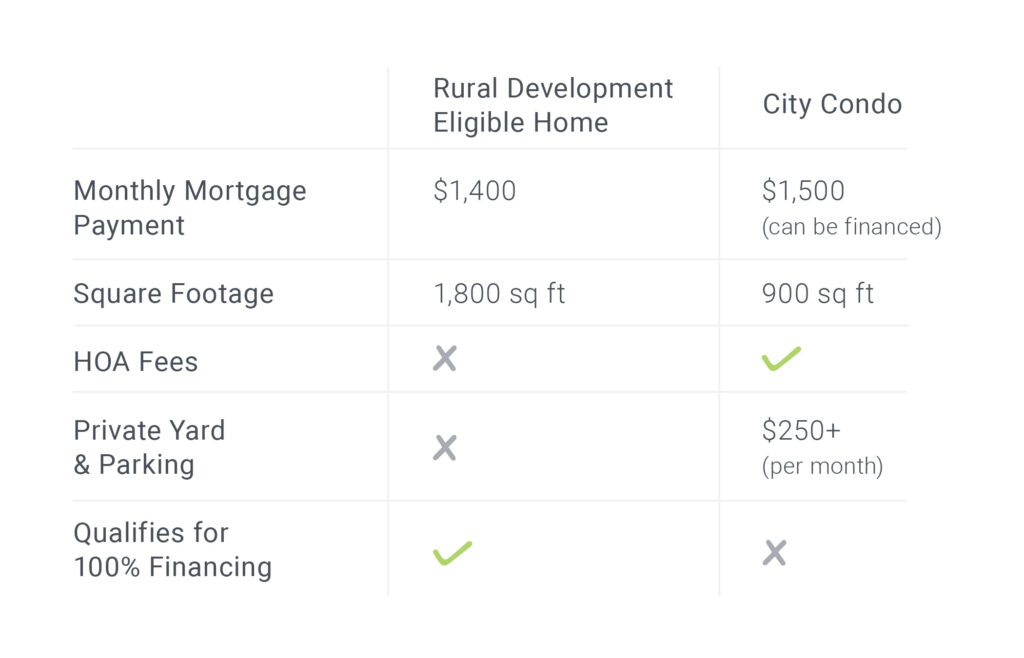

Here’s a breakdown of what living in an RD-eligible suburban home offers compared to a city condo:

Ready to See If You Qualify?

Don’t let myths and misinformation keep you on the sidelines. If you’re curious whether an RD Loan could work for you, the best next step is to talk it through with a local expert. At Treadstone, we make it easy to check your eligibility and walk you through your options — no pressure, no guesswork.

Reach out today and let’s find out if a zero-down RD Loan can help you unlock the front door to your next home.

FAQs

What will disqualify you from an RD Loan?

You can be disqualified from an RD Loan if your household income exceeds the USDA’s local limits, the property isn’t in an eligible area, or your credit and debt-to-income ratio don’t meet the guidelines. Other red flags include recent bankruptcies, unpaid federal debts, or inconsistent employment history without explanation.

How does a Rural Development Loan work?

An RD Loan is a government-backed mortgage designed to help buyers purchase homes in eligible rural and suburban areas. It offers 100% financing, meaning no down payment is required, and comes with low interest rates and reduced mortgage insurance costs. The USDA guarantees the loan through approved lenders, making it more accessible to buyers who meet the income and location requirements.

How hard is it to qualify for a USDA Loan?

Qualifying for a USDA Loan is often easier than people expect, especially compared to Conventional Loans. If you have a credit score of 640 or higher, stable income, and your household income falls within the USDA limits for your area, you’re already in a strong position. As long as the home is in an eligible location and your debt-to-income ratio is reasonable, qualifying can be surprisingly straightforward.

Is there a downside to an RD Loan?

While RD Loans offer major perks, there are a few potential downsides to consider. The property must be in a USDA-eligible area, which can limit your options, and there are income caps based on location and household size. Also, RD Loans come with a guarantee fee (similar to mortgage insurance), which adds a bit to your monthly payment — though it’s typically lower than what you’d pay with other loan types.

Have more questions? We’ve got plenty more blogs about the in’s & out’s of USDA Loans. Better yet, get in touch with one of our Loan Officers who will be able to walk you through the program!

T hese myths are costing buyers big time